Back in 2017, Hong Kong-based mobile game developer Animoca Brands was valued at less than $6. The emergence of NFT and the belief in the prospects of this technology led to the fact that today the company is worth about $8 billion. Let’s discuss the amazing path of success taken by Animoca Brands founder Yat Siu.

Through Thorns to the Stars

Siu’s childhood was in the 1980s in Austria, where he felt disadvantaged because of his Chinese background. The growing popularity of computers and technology became a lifeline for the young student. At first, Yat mastered programming on PC from Texas Instrument, later calling it “more of an advanced calculator than a PC.” After saving some money, Yat Siu bought an Atari ST. He used it to make his first money creating software for musicians. The Atari manufacturer even recruited Siu and hired him as a consultant, disregarding his young age.

Outblaze

After working for Atari for a while, our hero decided to go on a free voyage. After dropping out of college, he founded more than a dozen companies before his first success came. In 1998 Siu incorporated Outblaze, an email service operator in Hong Kong. Ten years later, its cloud division was sold to IBM for a few hundred million dollars. The proceeds from the sale were used to bail out the parent company during the global crisis that raged during those years. This allowed Outblaze to survive the hard times.

Animoca

One day Yat Siu got the idea to digitize the children’s educational game “Baby Einstein,” popular in the 2000s. He asked Outblaze programmers to develop a mobile app based on the game. The app was wildly popular, having been downloaded more than 20 million times. Yat saw the opportunity in time and founded Animoca in 2011 - Outblaze’s game development division.

However, the road to success was not an easy walk. In 2012, all games produced by Animoca were suddenly removed from the AppStore. An explanation from Apple was never forthcoming. Siu, however, has his own opinion on the matter. The reason was his business strategy to release a new game every 7 days, which was perceived as spam. He had to adjust to the new conditions and start releasing licensed games of famous brands. It paid off, and in 2013 Animoca was able to sell its products through the AppStore again. But then a new blow followed - Apple removed the category in which the company’s games were represented from the store. This led to a drop in sales and Animoca had to declare bankruptcy in 2017.

NFT and Yat Siu

It didn’t take long for Yat Siu to indulge in despondency. He began looking for new ways to grow the business. The founder of one of the startups that Yat was investing in told him about his new idea, the NFT project Cryptokitties. It soon changed the world completely. The popularity of Cryptokitties was so great that the Ethereum blockchain was no longer able to handle the load, with transaction fees reaching hundreds of dollars. Users could wait days for a transfer. But here, too, another blow of fate awaited Yat Siu. Soon crypto winter came, cryptocurrency rates collapsed several times, and money was melting before his eyes.

However, Yat didn’t give up. At one of the NFT conferences, which in 2018 brought together only “250 fanatics” from around the world, he partnered with several companies. Within a couple of years, they had already become pillars of a new industry - OpenSea, The SandBox, and Decentraland.

Animoca’s focus on the crypto market caught the attention of Australian regulators who were wary of this asset class. The Australian Stock Exchange, where the company was listed, imposed strict conditions - get rid of the virtual assets or Animoca’s papers would be removed from trading.

“It was scary. After delisting, no stock exchange would agree to list your company’s stock again,” Siu recalls.

In the spring of 2020, after 5 years on the exchange, Animoca stock was removed from the site. Later, because of the explosive growth of the crypto market, exchange representatives allowed for the possibility of changing the rules in the future. This means that blockchain companies will be able to be represented on the exchange. But Animoca shares still do not exist on any stock exchange.

How are Yat Siu`s investments now?

Yat Siu’s investment portfolio currently includes more than 150 NFT-related assets. Under Animoca’s management are stakes in companies like:

- Open Sea, the largest NFT marketplace with about $400 million in revenue in 2021.

- Dapper Labs, a developer of the NBA Top Shots platform with more than $1 billion in revenue in 2020.

- SkyMavis, the developer of the blockchain game Axie Infinity, with an estimated $3 billion in revenue.

- The Sandbox, a blockchain project with a market capitalization of $4.5 billion.

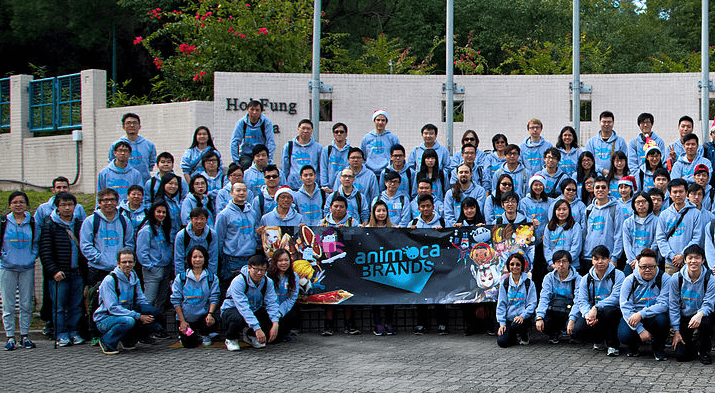

The company itself raised $360 million in another round of investment earlier this year. That boosted its capitalization to $5.4 billion, exceeding the figure by 2.5 times in less than six months. Animoca now employs more than 600 people and has achieved nearly $700 million in revenue for 3 quarters of 2021. As of November 2021, the company owns more than $16 billion in digital assets.

What is expected in the future?

Siu himself is confident that in the coming years, the NFT market will grow at the same rate as the year before. Recall that in 2020 it was estimated at only 100 million dollars, and in 2021 - already at 25 billion dollars. According to Yat, this will contribute to the development of meta universes, which everyone started talking about at the end of last year.

However, some analysts have the opposite point of view. For example, Samson Mow, BlockStream’s chief technology officer, believes that game companies are unlikely to agree to merge their meta universes.

“If you buy any weapon in Call of Duty (publisher Activision), Ubisoft won’t want you to bring it to Rainbow Six, because you won’t buy a weapon from them,” he explains his point of view.

And you can’t be sure of long-term success with NFT, actually, just like with any crypto-asset. The AXS token of the Axie Infinity project is already 50% cheaper in 2022. EA’s CEO Andrew Wilson, one of the largest game companies in the world, has abandoned plans to add NFT to the company’s products after a negative reaction from the community. Valve has removed all NFT and blockchain-related games from Steam. Phil Spencer - Microsoft’s CEO - generally said that the Play-to-Yearn model, on which top blockchain games are based, is focused more on user exploitation than on user entertainment.” - Samson Mow

Siu, on the other hand, continues to believe that NFT games are the next step in the evolution of online gaming. And he is already busy developing a new AAA project that will turn the industry upside down. Time will tell whether this will be true.